The biggest blunder any investor can make in real estate is to shop too early for money, yet this is the most common mistake we see investors making in real estate. The rule of thumb is it’s much easier to shop for cash when you have a deal in hand and under contract.

Why? Because as long as that property is not under contract, it’s up for grabs by anyone and everyone and no lender will spend time and resources on a property that can be snatched out from under the borrower at any moment’s notice.

Putting the house under contract is an easy enough, 4-Step process.

- Step 1:Prospect and Review Potential Properties

- Step 2:Write Offers

- Step 3:Get Offer Accepted by Seller

- Step 4:Put Earnest Money in Escrow to complete the contract.

Once these 4 Steps are completed, you have a fully executed Purchase and Sale Agreement, the property is under contract, and you are ready to shop for cash. If you’re ready to move forward and receive a term sheet, then fill out the form at the bottom of the page and we will get back to you within 24 business hours.

WHAT IS HARD MONEY?

It goes by a lot of different terms. You’ve probably heard it referred to as, “Private Money,” “Equity-Based Financing,” “Bridge Financing,” or “Creative Financing,” and for the most part, they all mean the same thing.

It’s non-traditional financing that relies on the property’s merits, rather than your personal qualifications. These types of loans are often secured by a note and deed of trust in first lien position on the property.

5 Reasons Why Investors Use Private Money

Having a Private Money Lender, like WE Group Capital in your court gives you confidence to put properties under contract. As long as you find the no-brainer deal that fits our guidelines, do the proper due-diligence, and turn in an application. you can be rest-assured that the deal will be funded!

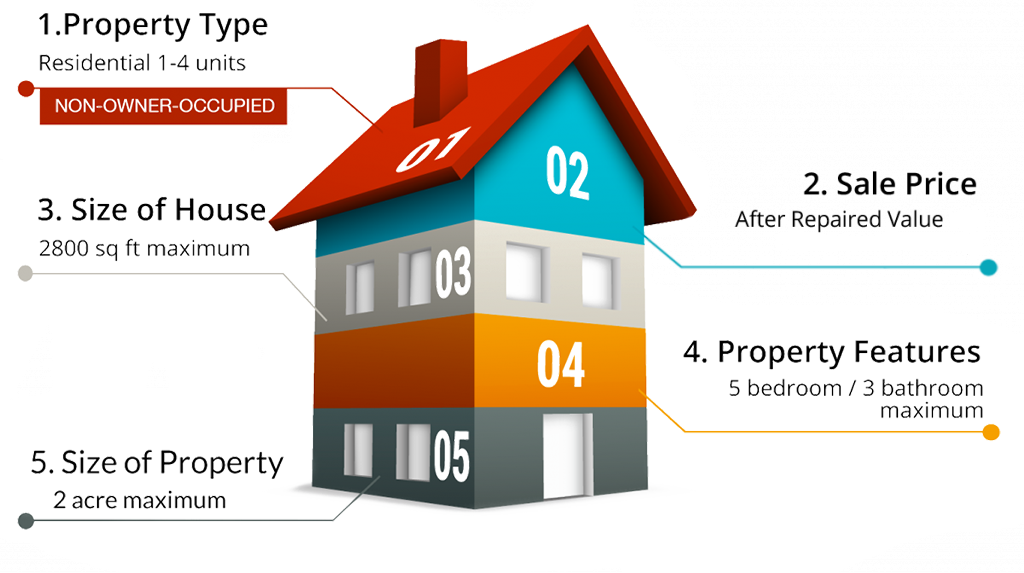

At WE Group Capital we are only interested in funding projects that will give you the best opportunity at realizing success. Therefore, our criteria is centered around these 5 points:

The first part of every successful fix and flip is finding the right real estate property. That’s why we’ve created this easy, 5-point guide to help you find the “sweet spot” deal, which can give you the best chance at making money in real estate, while safeguarding your investment.

Homes above the FHA cap are statistically more likely to experience drastic fluctuations in value and can be more susceptible to local and overall market depreciation. Homes in the 5-point realm tend to be more resilient to these influences.

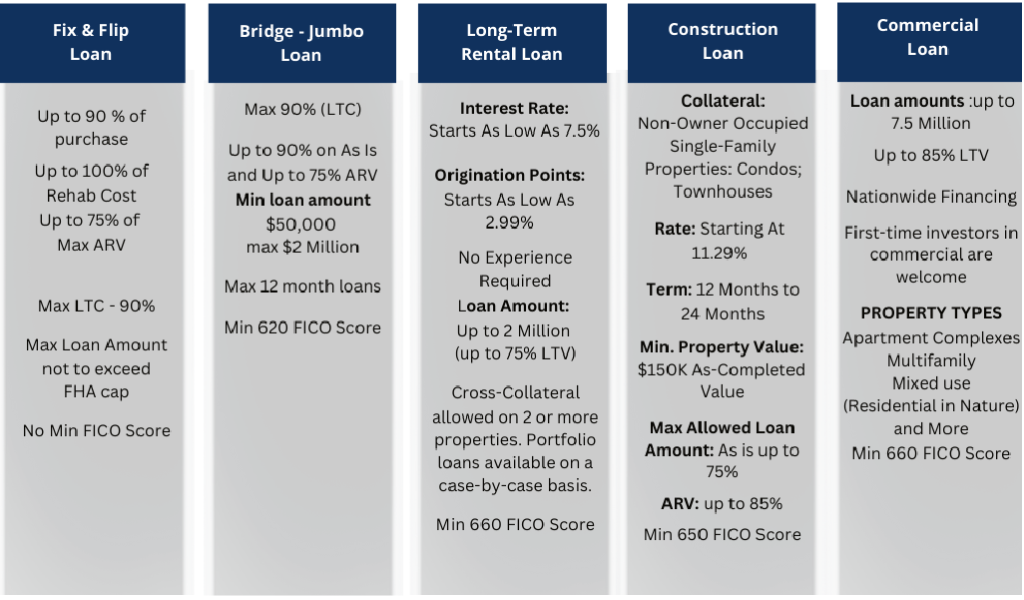

Types of Deals WE Group Capital

Loan Terms

1. Max Loan Amount: Just Bring Us Your Deal! No cap on the loan amount if the numbers make sense. Rest assured; we will help you get it done. Call us today for more details. WE Group Capital has funding solutions from $30,000 up to the FHA Cap in the county where the investment property is located and can provide additional lending solutions based on the property you have under contract and type of loan needed.

2. Rates: Current rates start at 7.5% annualized interest with an origination fee from 0-5%, and no prepayment penalties. (Rates are based on credit score but credit score does NOT determine loan approval.)

3. Loan Term: 6 Months to 2 Years for a fix & flip. 30 Years for a buy & hold or refinance. One loan approved per applicant until proven track record

Please complete the form below, and we’ll get in touch with you within 24 business hours to provide a no-obligation term sheet.